CTO Guide to Technology Vendor Evaluation: Strategic Selection Framework

Technology vendor selection has become one of the most consequential decisions enterprise CTOs make. The proliferation of SaaS platforms, cloud services, and enterprise software means organizations now depend on dozens or hundreds of technology vendors for critical business capabilities. Poor vendor choices create technical debt, security vulnerabilities, and switching costs that constrain future options. Excellent vendor relationships enable capabilities that would be impossible to build internally while providing flexibility to evolve with changing needs.

Yet vendor evaluation often receives insufficient rigor. Procurement focuses on price while ignoring total cost of ownership. Technical evaluation validates current requirements without considering architectural evolution. Security review checks compliance boxes without assessing actual risk posture. The result is vendor portfolios that underperform expectations and create ongoing operational burden.

This guide provides a systematic approach to vendor evaluation that balances thoroughness with practical constraints, helping CTOs make vendor decisions that serve both immediate needs and long-term strategic interests.

Strategic Context for Vendor Decisions

Effective vendor evaluation begins before evaluating specific vendors, with clarity about strategic context and requirements.

Build vs. Buy Framework

When to Build:

Internal development makes sense when the capability provides core competitive differentiation, requirements are highly specialized with limited market solutions, integration requirements exceed available API capabilities, or long-term cost of ownership favors internal development.

Building creates control and customization but requires engineering investment, ongoing maintenance commitment, and organizational capability to execute effectively.

When to Buy:

Vendor solutions are appropriate when the capability is well-served by existing market offerings, time-to-value requirements exceed internal development timelines, vendor specialization provides better capability than internal teams could achieve, or total cost of ownership favors subscription versus internal development.

Buying provides speed and specialization but creates dependency and limits customization.

When to Partner:

Partnership models suit situations where capability requires specialized expertise unavailable internally, strategic relationship provides advantages beyond the specific capability, or co-development enables differentiation not available from standard products.

Partnerships require relationship management and alignment mechanisms beyond standard vendor management.

Category Strategy

Before evaluating individual vendors, establish category strategy:

Strategic Categories: Technologies central to competitive differentiation. Accept higher investment for deeper vendor relationships, customization, and influence over product direction.

Commodity Categories: Technologies that are table stakes without differentiation potential. Prioritize cost efficiency and operational simplicity. Avoid over-engineering vendor selection for commodity needs.

Emerging Categories: Technologies with strategic potential but immature markets. Accept vendor risk for innovation access. Plan for market consolidation and potential vendor transitions.

Category classification guides evaluation depth, relationship investment, and acceptable risk levels.

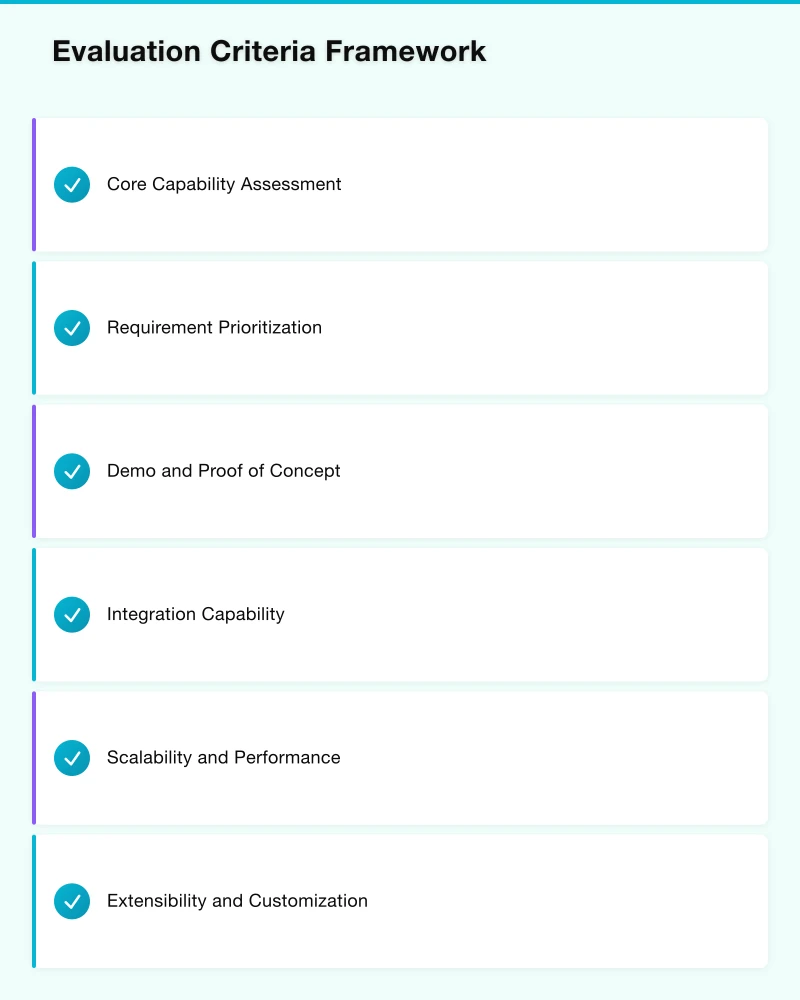

Evaluation Criteria Framework

Systematic evaluation requires criteria that address multiple dimensions of vendor fitness.

Functional Requirements

Core Capability Assessment:

- Does the solution meet stated requirements?

- What percentage of requirements are met natively versus requiring customization?

- How does capability compare to alternatives?

- What capability gaps exist and how significant are they?

Requirement Prioritization: Not all requirements carry equal weight. Distinguish between must-have capabilities where gaps are disqualifying, important capabilities where gaps require workarounds, and nice-to-have capabilities where gaps are acceptable.

Weighted scoring prevents minor gaps from disqualifying superior overall solutions.

Demo and Proof of Concept: Validate claimed capabilities through demonstrations with realistic scenarios, proof-of-concept implementations for complex requirements, and reference checks on similar use cases. Sales demonstrations optimized for impression differ from actual operational use.

Technical Architecture

Integration Capability:

- API completeness and documentation quality

- Authentication and authorization mechanisms

- Event and webhook support

- Bulk data access capabilities

- Integration pattern flexibility

Poor integration capabilities create ongoing friction and limit automation potential.

Scalability and Performance:

- Architecture supporting growth requirements

- Performance characteristics under load

- Multi-tenancy architecture and isolation

- Geographic distribution capabilities

Evaluate against projected requirements, not just current state.

Extensibility and Customization:

- Configuration versus customization capabilities

- Custom development platforms and tooling

- Upgrade path impact on customizations

- Partner ecosystem for extensions

Extensibility requirements should reflect actual customization intentions, not theoretical possibilities.

Data Architecture:

- Data model accessibility and documentation

- Data portability and export capabilities

- Data residency options

- Backup and recovery mechanisms

Data considerations affect both operational flexibility and exit planning.

Security and Compliance

Security Posture Assessment:

- Security certifications (SOC 2, ISO 27001, etc.)

- Security architecture and controls

- Vulnerability management practices

- Incident response capabilities

- Third-party security assessments

Security evaluation depth should match data sensitivity and risk exposure.

Compliance Alignment:

- Regulatory compliance relevant to your industry

- Data protection compliance (GDPR, Privacy Act, etc.)

- Audit support and reporting capabilities

- Contractual compliance commitments

Verify compliance claims through documentation review, not just vendor assertions.

Security Due Diligence:

- Penetration testing results

- Security questionnaire responses

- Infrastructure security practices

- Employee security training and background checks

High-risk vendors warrant deeper security due diligence.

Vendor Viability

Financial Health:

- Revenue trends and profitability

- Funding status and runway

- Customer concentration risk

- Public financial disclosures if available

Financial assessment protects against vendor failure disrupting operations.

Market Position:

- Market share and competitive position

- Analyst assessments and rankings

- Customer momentum and win rates

- Competitive differentiation sustainability

Strong market position suggests continued investment and support.

Strategic Direction:

- Product roadmap alignment with your needs

- Investment priorities and resource allocation

- Executive stability and vision

- Acquisition risk (acquirer compatibility)

Strategic direction affects long-term partnership viability.

Operational Considerations

Implementation Approach:

- Implementation methodology and timeline

- Resource requirements (vendor and customer)

- Risk factors and mitigation approaches

- Success criteria and measurement

Realistic implementation assessment prevents project overruns.

Support Model:

- Support tiers and response commitments

- Support channel availability

- Escalation procedures

- Customer success resources

Support adequacy directly affects operational experience.

Operational Reliability:

- Uptime history and SLA commitments

- Incident transparency and communication

- Disaster recovery capabilities

- Maintenance windows and change management

Reliability expectations should align with business criticality.

Total Cost of Ownership

Direct Costs:

- Subscription or license fees

- Implementation and professional services

- Integration development

- Training and change management

Ongoing Costs:

- Support and maintenance fees

- Usage-based cost projections

- Upgrade and migration costs

- Internal administration resources

Hidden Costs:

- Integration maintenance

- Customization maintenance

- Staff time for vendor management

- Opportunity cost of limitations

TCO analysis over 3-5 years provides better comparison than initial costs alone.

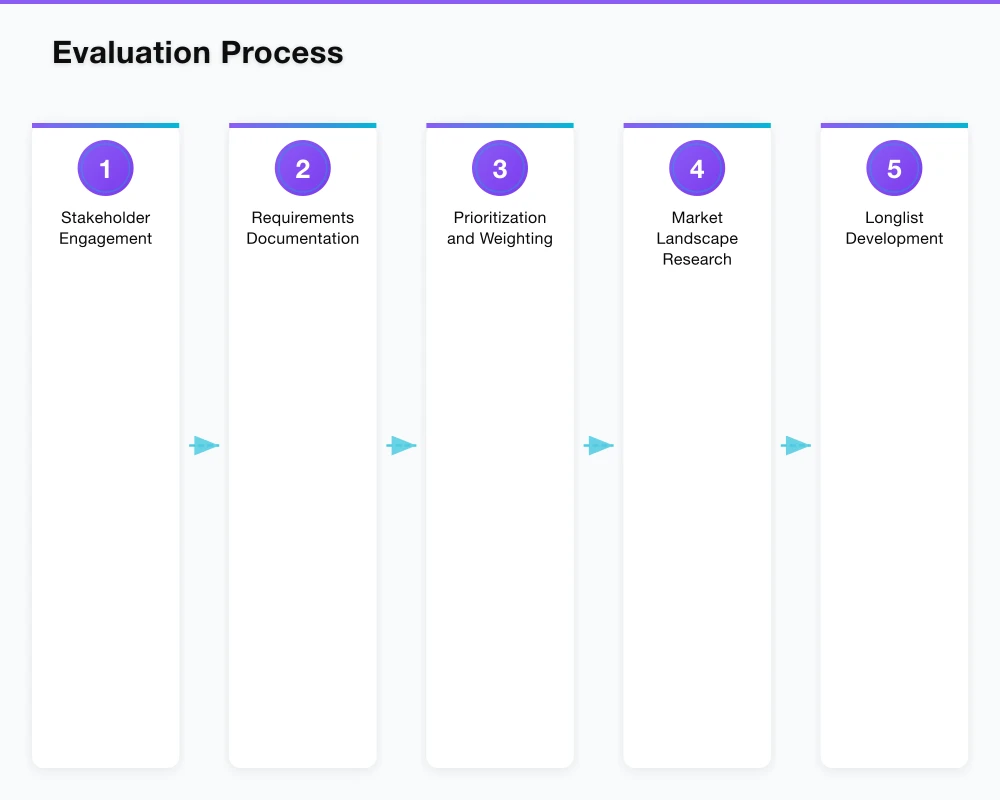

Evaluation Process

Structured process ensures thorough evaluation while managing effort.

Requirements Definition

Stakeholder Engagement: Gather requirements from all affected stakeholders:

- Business users defining functional needs

- IT teams specifying technical requirements

- Security teams establishing security standards

- Finance teams setting budget constraints

- Legal teams identifying contractual requirements

Requirements Documentation: Document requirements in formats enabling consistent vendor assessment. Requirements should be specific enough for evaluation yet not so detailed as to exclude innovative approaches.

Prioritization and Weighting: Establish requirement priorities and evaluation weights before vendor engagement. Post-hoc weighting adjustments to justify preferred vendors undermine evaluation integrity.

Market Assessment

Market Landscape Research: Before engaging vendors, understand market landscape through analyst reports and market guides, peer organization experiences, online reviews and forums, and conference and community intelligence.

Longlist Development: Identify candidate vendors meeting minimum criteria. Cast wide initially; narrow through structured screening.

Shortlist Selection: Screen longlist to manageable shortlist (typically 3-5 vendors) for detailed evaluation. Screening criteria should eliminate clearly unsuitable options while preserving diverse alternatives.

Vendor Engagement

Request for Information (RFI): For complex evaluations, RFI gathers initial information to enable informed RFP development and shortlist refinement.

Request for Proposal (RFP): Formal RFP provides consistent evaluation framework:

- Standardized questions enabling comparison

- Requirement response format

- Pricing structure requirements

- Reference information requests

- Demo and POC expectations

Evaluation Scoring: Score vendor responses against defined criteria with established weights. Multiple evaluators reduce individual bias. Scoring should be documented and defensible.

Due Diligence

Technical Validation: Validate technical claims through demonstrations, proof-of-concept projects, or technical deep dives. Technical architecture review assesses integration approach and long-term fit.

Security Review: Security team evaluation of security posture. For high-risk vendors, this may include penetration testing, security questionnaire review, and infrastructure assessment.

Reference Checks: Speak with existing customers, ideally with similar use cases, scale, and industry context. Ask about implementation experience, ongoing operations, support quality, and relationship satisfaction.

Financial Due Diligence: For strategic vendors, review financial health through financial statements, funding disclosures, and market position analysis.

Decision and Negotiation

Recommendation Development: Synthesize evaluation into recommendation with clear rationale, risk assessment, and comparison to alternatives.

Stakeholder Alignment: Ensure stakeholders support recommendation before committing resources to negotiation.

Contract Negotiation: Negotiate contract terms addressing pricing and payment terms, service level commitments, security and compliance obligations, data ownership and portability, termination and transition provisions, and liability and indemnification.

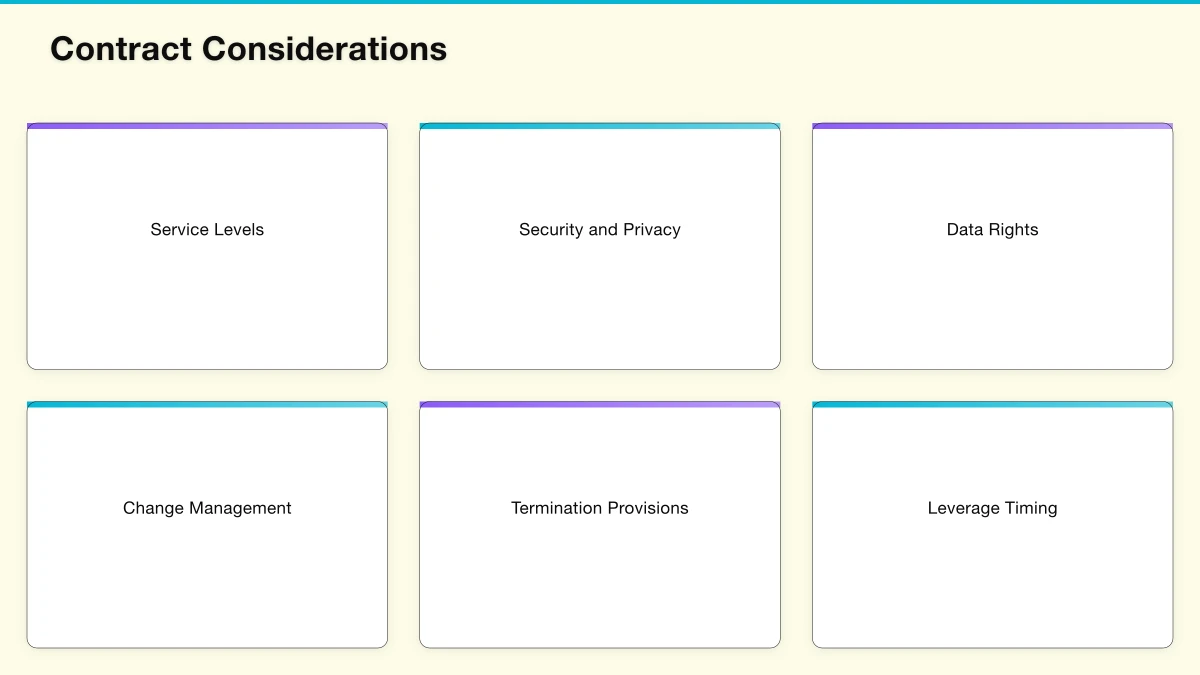

Contract Considerations

Contract terms significantly affect long-term relationship dynamics.

Key Contract Elements

Service Levels: Define measurable service level commitments with meaningful remedies for failures. Ensure SLAs cover metrics that matter to your operations.

Security and Privacy: Contractually commit vendor to security standards, compliance obligations, and incident notification requirements.

Data Rights: Establish clear data ownership, access rights, portability provisions, and deletion obligations upon termination.

Change Management: Define processes for price changes, service modifications, and term renewals. Protect against unilateral changes that disadvantage customers.

Termination Provisions: Ensure ability to exit with reasonable notice, transition support obligations, and data extraction rights.

Negotiation Strategies

Leverage Timing: Vendor flexibility increases near quarter-end and year-end when sales targets drive urgency.

Multi-Year Commitment: Multi-year terms often unlock substantial discounts. Balance savings against lock-in risk.

Competitive Tension: Maintaining credible alternatives through final selection improves negotiating position.

Executive Engagement: Vendor executive involvement may unlock flexibility beyond standard sales authority.

Professional Support: Legal and procurement expertise ensures contract terms protect organizational interests.

Vendor Relationship Management

Selection is the beginning, not the end, of vendor relationships.

Governance Framework

Relationship Ownership: Assign clear ownership for each vendor relationship. Owners ensure value delivery, manage issues, and maintain relationship health.

Review Cadence: Establish regular review meetings appropriate to relationship importance:

- Strategic vendors: Quarterly business reviews with executive participation

- Important vendors: Semi-annual operational reviews

- Standard vendors: Annual renewal reviews

Performance Monitoring: Track vendor performance against contracted commitments and operational expectations. Document issues and resolution.

Ongoing Evaluation

Value Realization: Regularly assess whether anticipated value is being realized. Identify and address gaps between expectations and reality.

Market Comparison: Periodically reassess market alternatives. Vendor relationships should remain competitive even during contract terms.

Relationship Health: Monitor relationship quality indicators:

- Support satisfaction

- Issue resolution effectiveness

- Responsiveness to feedback

- Innovation and proactive engagement

Exit Planning

Continuous Exit Readiness: Maintain exit capability even for strong vendor relationships:

- Current data exports

- Documented dependencies

- Alternative assessment currency

- Transition procedure understanding

Exit readiness provides negotiating leverage and risk mitigation.

Transition Execution: When vendor transitions are necessary, plan thoroughly:

- Parallel operation period

- Data migration validation

- User training and change management

- Contract termination execution

Common Pitfalls and Mitigation

Vendor selection commonly fails through predictable patterns.

Feature Fixation: Overweighting feature comparisons while underweighting implementation, support, and total cost of ownership.

Mitigation: Balanced evaluation criteria weighted appropriately across all dimensions.

Demo Seduction: Allowing polished demonstrations to override systematic evaluation.

Mitigation: Proof-of-concept validation with realistic scenarios.

Reference Bias: Accepting vendor-selected references as representative.

Mitigation: Request diverse references and seek independent references through network.

Vendor Lock-In Underestimation: Underestimating switching costs and lock-in implications.

Mitigation: Explicit assessment of lock-in factors and exit costs.

Price Pressure: Excessive focus on initial price at expense of total cost of ownership.

Mitigation: TCO analysis over appropriate time horizon.

Scope Creep: Requirements expanding during evaluation, invalidating earlier assessments.

Mitigation: Requirements baseline with change control.

Decision Fatigue: Extended evaluations leading to suboptimal decisions from exhaustion.

Mitigation: Defined timeline with decision forcing functions.

Looking Forward: Vendor Landscape Evolution

The technology vendor landscape continues evolving with implications for evaluation approaches.

Platform Consolidation: Enterprises increasingly prefer consolidated platforms over best-of-breed point solutions. Evaluation should consider platform strategy and vendor ability to expand relationship scope.

AI Integration: AI capabilities are becoming table stakes across software categories. Evaluate AI functionality, data handling, and model governance.

Consumption-Based Pricing: Usage-based pricing models require different cost analysis approaches than traditional subscriptions. Model usage scenarios carefully.

Security Scrutiny: Vendor security requirements continue intensifying. Budget for thorough security due diligence.

Exit Complexity: SaaS entrenchment makes vendor transitions increasingly complex. Prioritize portability and exit provisions.

For CTOs, disciplined vendor evaluation has become a core capability that directly affects organizational agility, cost structure, and risk posture. Organizations that master vendor evaluation build technology portfolios that enable strategy rather than constraining it.

Sources

- Gartner. (2024). Magic Quadrant for Cloud Infrastructure and Platform Services. Gartner Research.

- Forrester Research. (2024). The Forrester Wave: Enterprise Architecture Management Suites. Forrester.

- IACCM. (2024). Contract Management Best Practices. International Association for Contract and Commercial Management.

- CIO Magazine. (2024). Vendor Management Best Practices. IDG Communications.

- Harvard Business Review. (2024). Strategic Vendor Relationships. Harvard Business Publishing.

Ash Ganda is a technology executive with extensive experience in enterprise technology strategy and vendor management. Connect on LinkedIn to discuss technology vendor evaluation for your organization.