Scaling Engineering Teams: A CTO Guide to Hiring in Competitive Markets

Introduction

The engineering talent market has never been more competitive. Every company is now a technology company, and the demand for software engineers vastly exceeds supply. CTOs face a challenging paradox: business growth depends on engineering capacity, but scaling engineering teams has become one of the hardest problems in enterprise leadership.

This year has intensified the challenge. Remote work has eliminated geographic constraints, meaning your engineers can be recruited by any company in the world. Compensation expectations have escalated dramatically. Traditional hiring approaches that worked even two years ago now feel hopelessly outdated.

Having scaled multiple engineering organisations through these conditions, I’ve learned that success requires rethinking hiring as a strategic function rather than an administrative process. The CTOs who build strong teams treat recruiting with the same rigour they apply to system architecture.

Understanding the Market

Supply and Demand Reality

The fundamental equation is straightforward: global demand for software engineers is growing faster than educational systems can produce them. This isn’t a temporary pandemic effect—it’s a structural condition that will persist for years.

Consider the numbers: major technology companies alone are trying to hire tens of thousands of engineers annually. Add enterprise digital transformation, startup growth, and the expansion of software into every industry, and the demand is staggering. Meanwhile, computer science enrolments, while growing, can’t keep pace.

This means hiring is not about finding qualified candidates in a talent pool—it’s about competing successfully for candidates who have multiple attractive options.

What Candidates Want

Understanding candidate priorities is essential for competitive positioning. Based on extensive interviews with engineers considering job changes:

Compensation matters, but it’s table stakes. Engineers expect competitive pay. Below-market offers are immediately rejected. But above a threshold, compensation alone doesn’t differentiate.

Interesting problems are a primary motivator. Engineers want to work on challenges that develop their skills and matter in the world. The nature of the work outweighs perks and benefits.

Team quality matters enormously. Strong engineers want to work with other strong engineers. The calibre of potential colleagues significantly influences decisions.

Autonomy and trust are expected. Micromanagement is a deal-breaker. Engineers expect to be given problems to solve, not tasks to execute.

Growth trajectory must be visible. Where does this role lead? What will I learn? How will my career advance? Candidates evaluate opportunity, not just the current position.

Work-life balance has become non-negotiable. The pandemic clarified priorities for many. Companies expecting 60-hour weeks face candidate withdrawal.

Building Your Employer Brand

Authenticity Over Marketing

Engineering candidates are sophisticated consumers of employer branding. They see through generic claims about “culture” and “innovation.” What works is authentic communication about what it’s actually like to work at your organisation.

Effective employer branding includes:

Technical blogging: Engineers writing about interesting problems they’re solving. This demonstrates both the nature of work and the calibre of thinking. It also helps with SEO when candidates research your company.

Open source participation: Contributing to open source shows engineering values and provides a direct sample of how your engineers work. Candidates can evaluate code quality before applying.

Conference speaking: Engineers presenting at industry events builds credibility and visibility. It’s also a development opportunity that strong candidates value.

Honest Glassdoor management: Rather than fighting negative reviews, respond thoughtfully and address legitimate concerns. Candidates read reviews carefully and value authenticity.

Visible engineering leadership: CTOs and engineering leaders who write, speak, and engage publicly attract candidates who want to work with visible leaders.

Differentiation Strategy

Every company claims great culture, smart people, and interesting work. How do you actually differentiate?

First, identify what’s genuinely distinctive about your engineering organisation. Not what you wish were true—what actually is true. This requires honest assessment, possibly including anonymous surveys of current engineers.

Common genuine differentiators include:

- Unusual technical challenges (scale, domain complexity, performance requirements)

- Specific technologies or approaches (functional programming shop, ML-native architecture)

- Engineering culture elements (strong testing culture, documentation-first, pair programming)

- Business model advantages (profitability enabling long-term thinking, mission-driven work)

- Team structure (small autonomous teams, research-oriented groups)

Once identified, communicate these differentiators consistently across all recruiting touchpoints.

Process Design

Speed as Competitive Advantage

The single highest-leverage improvement most organisations can make is accelerating their hiring process. In competitive markets, slow processes lose candidates.

Target metrics:

- Initial response: Within 24 hours of application

- First interview: Within one week of initial response

- Complete process: Within three weeks from first interview to offer

- Offer decision window: Allow reasonable time (one week), but be prepared to move faster for exceptional candidates

This requires:

- Pre-authorised headcount so hiring managers can move without approval delays

- Calendar blocks for interviewers ensuring availability

- Same-day debrief after final interviews

- Pre-negotiated offer flexibility so decisions don’t require escalation

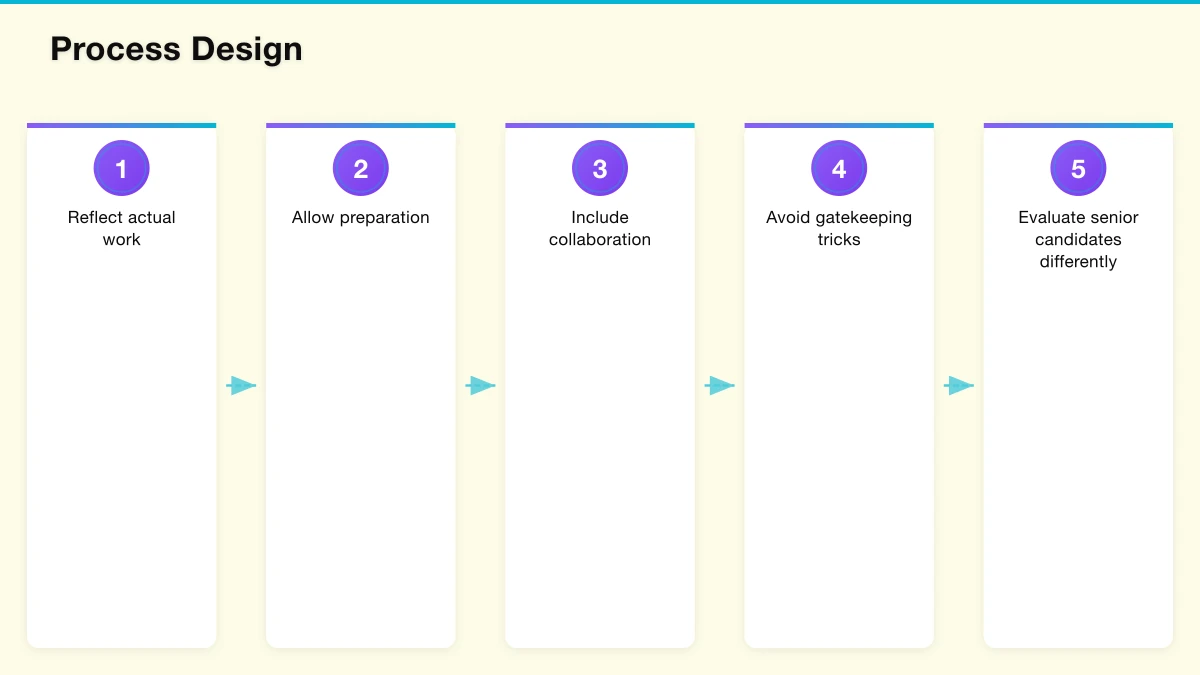

Interview Design

Interviews should assess candidate capability while providing candidates information to evaluate your organisation. Both directions matter.

Effective technical interviews:

Reflect actual work: Interview problems should resemble the work candidates will do. If you never whiteboard algorithms in your job, don’t make candidates whiteboard algorithms in interviews.

Allow preparation: Surprise assessments test interview skills, not job skills. Provide context about what interviews will cover so candidates can prepare.

Include collaboration: Pair programming exercises or collaborative design discussions reveal how candidates work with others—often more important than solo performance.

Avoid gatekeeping tricks: Interview questions designed to trip candidates up don’t identify good engineers. They identify engineers who happened to know that specific trick.

Evaluate senior candidates differently: Senior engineers should be assessed on system design, architectural thinking, and leadership capability—not coding speed.

Non-technical assessment matters too:

- How do they communicate complex ideas?

- How do they handle disagreement?

- Do they ask good questions?

- Can they admit what they don’t know?

Structured Evaluation

Unstructured interviews produce biased, unreliable results. Implement structure:

Defined competencies: What specifically are you evaluating? Technical depth, system design, collaboration, communication? Be explicit.

Consistent questions: All candidates for a role face similar questions, enabling meaningful comparison.

Independent evaluation: Interviewers submit feedback before discussing. Group discussion after submission to prevent anchoring.

Explicit criteria: What does “meets bar” mean for each competency? Document it so evaluation is consistent across interviewers.

Calibration sessions: Regular sessions where interviewers discuss past decisions and calibrate evaluation standards.

Sourcing Strategies

Beyond Job Postings

Posting jobs and waiting for applications is necessary but insufficient. Most strong candidates aren’t actively job searching—they need to be found.

Effective sourcing approaches:

Employee referrals: Consistently the highest-quality source. Make referral programs generous and frictionless. Current employees know candidate quality and cultural fit.

Engineering network cultivation: Build relationships before you need to hire. Attend meetups, host events, engage in online communities. When hiring, these relationships convert.

Selective recruiter partnerships: Quality varies enormously. Find recruiters who understand technical roles and invest in long-term relationships. Avoid contingency recruiters who spray resumes.

GitHub and open source: Review contributors to projects you use. Evaluate code quality directly. Reach out to strong contributors.

Competitive intelligence: Know who’s strong at competitor companies. When circumstances change (layoffs, acquisitions, leadership changes), move quickly.

Expanding the Talent Pool

The traditional hiring pool (CS graduates from top universities with big tech experience) is exhausted and inaccessible for most companies. Expanding your definition of qualified candidates opens new sources:

Bootcamp graduates: Quality varies, but strong bootcamp graduates can be excellent. Evaluate demonstrated skill, not credentials.

Career changers: Engineers who came to software from other fields often bring valuable perspective and strong motivation.

Geographic expansion: Remote work enables hiring from locations with less competition. An excellent engineer in a secondary market may be more accessible than a good engineer in a major tech hub.

Return-to-work candidates: Parents who took career breaks, often women, represent an underutilised talent pool. Structured return programs work well.

International candidates: Immigration complexity is real, but visa sponsorship opens access to global talent.

Each expansion requires adjusting evaluation to assess capability rather than credential proxies. Strong bootcamp graduates may struggle with algorithm interviews but excel at practical engineering work.

Compensation Strategy

Market Positioning

Decide your compensation strategy explicitly:

Premium positioning (top 25%): Attracts more candidates, reduces negotiation friction, improves retention. Expensive but reduces hiring difficulty.

Market positioning (50th percentile): Competitive but requires differentiation on other factors. Works when culture, work, or mission are genuinely distinctive.

Below-market positioning: Only sustainable with exceptional differentiation (early-stage equity, unique mission, extraordinary growth opportunity). Gets harder as company scales.

Total Compensation Design

Cash salary is only one component. Design total compensation to appeal to your target candidates:

Base salary: Provides security and is the number most easily compared across offers. Don’t underpay base hoping equity makes up the difference.

Equity: For private companies, explain valuation, vesting, and exit scenarios clearly. Sophisticated candidates will discount heavily—unsophisticated candidates may overvalue.

Bonus: Annual bonuses tied to company or individual performance. Less valued than equivalent base salary by most candidates.

Benefits: Health insurance, retirement contributions, parental leave. These matter more to some candidates than others.

Perks: Food, wellness benefits, equipment budgets. Nice to have but rarely decision factors.

Negotiation Approach

Some companies prohibit negotiation, citing fairness. This can work if initial offers are genuinely strong and consistent. More commonly, some negotiation flexibility is expected.

Guidelines for negotiation:

- Set ranges before discussions, based on level and market data

- Be willing to adjust within ranges without requiring justification

- Don’t penalise candidates who don’t negotiate

- Be creative with non-cash elements when budget constrained

- Move quickly once aligned—extended negotiation loses candidates

Retention Fundamentals

Hiring and Retention Are Connected

Every engineer who leaves creates a hiring need. Retention improvements directly reduce hiring pressure. Often, retention investment has higher ROI than sourcing investment.

The primary drivers of engineering turnover:

Manager quality: Engineers leave managers more than companies. Invest in engineering management capability.

Growth stagnation: Engineers who stop learning leave. Ensure career development, challenging work, and visible progression.

Compensation drift: Engineers hired a year ago at market rates may now be below market. Regular compensation reviews prevent departure-driven adjustments.

Burnout: Sustained overwork drives attrition. Sustainable pace is an investment in retention.

Cultural problems: Dysfunction, political environment, or poor treatment drives departure regardless of other factors.

Stay Interviews

Don’t wait for exit interviews to learn why people might leave. Regular “stay interviews” with valued team members surface issues while there’s still time to address them:

- What do you enjoy most about working here?

- What would you change if you could?

- What might cause you to look elsewhere?

- What career development do you want that you’re not getting?

These conversations, conducted by managers or skip-level, provide actionable retention intelligence.

Scaling Considerations

Maintaining Quality at Scale

Quality bar maintenance is the central challenge of scaling. Early hires often have exceptional quality; maintaining that standard at scale requires discipline.

Document the bar: What does “good enough” mean? What distinguishes exceptional from adequate? Write it down.

Train interviewers explicitly: Don’t assume interviewing skill. Provide training, mentorship, and shadowing before interviewers evaluate independently.

Monitor calibration: Track offer rates by interviewer. Unusual patterns indicate calibration drift.

Leadership involvement: Senior leadership should interview periodically across the organisation, both for calibration and to stay connected to incoming talent.

Organisational Design for Growth

How you structure growing teams affects hiring efficiency:

Clear leveling: Consistent levels across the organisation enable appropriate role matching. Ambiguous leveling confuses candidates and creates internal equity issues.

Team charters: Clear team missions help candidates evaluate fit. “Join our team” is less compelling than “join the team building X.”

Growth paths: Document how engineers progress. Candidates want to see their future, not just the current role.

Manager capacity: Don’t exceed reasonable span of control. Teams without adequate management support suffer, driving attrition that creates more hiring need.

Measuring Hiring Effectiveness

What gets measured improves. Key metrics for hiring:

Time to fill: Days from opening to accepted offer. Benchmark against targets and track trends.

Source quality: Which sources produce candidates who receive offers and perform well? Invest accordingly.

Pass-through rates: What percentage of candidates pass each interview stage? Unusual patterns indicate process issues.

Offer acceptance rate: Low acceptance suggests compensation, process, or employer brand problems.

New hire retention: What percentage of new hires are still present after 6 months, 12 months? Early departure suggests hiring or onboarding failures.

Hiring manager satisfaction: Are hiring managers getting candidates who succeed in role? Their assessment matters.

Conclusion

Scaling engineering teams in competitive markets requires treating hiring as a strategic capability, not an administrative function. Success comes from understanding what candidates want, building genuine employer brand differentiation, designing efficient and respectful processes, expanding sourcing creativity, and investing in retention that reduces hiring pressure.

The organisations that hire well share common characteristics: they move fast, they respect candidates’ time and intelligence, they communicate authentically, and they continuously improve based on results. These aren’t expensive investments—they’re operational discipline applied to a critical function.

For CTOs, hiring may not be the most technically interesting part of the role, but it’s among the most important. The quality of the team you build determines what’s possible. Every other technical decision is constrained by the capability of the people available to execute.

Invest accordingly.

Engineering hiring has become a core CTO competency. In competitive markets, the leaders who build great teams are those who treat recruiting with strategic importance, operational rigour, and continuous improvement. The time invested in hiring capability pays compound returns in everything else your organisation attempts.